The State of Wisconsin has an annual audit prepared in conformity with Generally Accepted Accounting Principles.

As a CPA, I am interested in the financial condition of our state. The GAAP basis audit accurately portrays the financial condition of the state.

The reason that there is a GAAP deficit in this state is that the state has historically “balanced” its books by using cash-basis budgeting. Over the years, it has led to all kinds of creative techniques to balance these books. Many of these techniques have been well publicized and include the sale of the tobacco settlement, raids of the Transportation Fund and the Patient Compensation Fund, withholding of payments to Minnesota, and delaying of state aids to school districts.

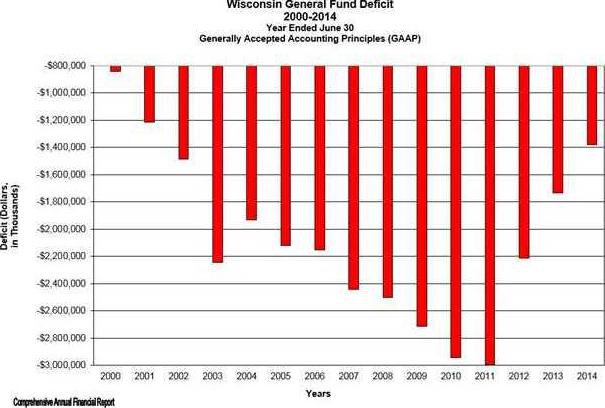

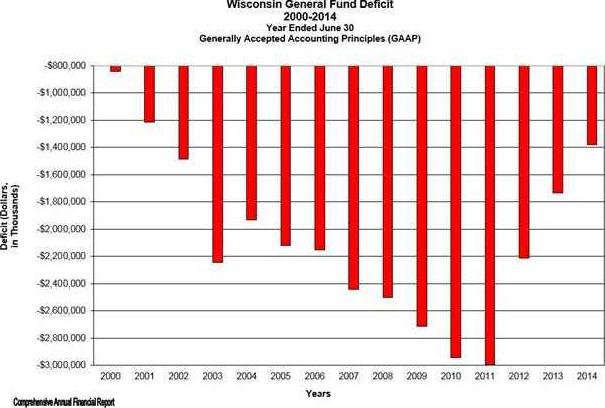

The path that we were on was unsustainable. By the end of fiscal year 2010, the general fund deficit had grown to nearly $3 billion! People were taking notice of these budgeting gimmicks. The bond rating agencies in New York were concerned about these deficits and it had a negative impact on our bond rating.

Tremendous progress has been made in the last three years. In 2010, the Wisconsin GAAP deficit stood at over $2.9 billion and today the GAAP deficit has decreased 52 percent to $1.4 billion. The decrease represents the fact that Wisconsin has made significant progress in achieving solvency and more honest accounting practices.

There is still more work to be done. I believe the only permanent solution is to have the voters in Wisconsin approve an amendment to the state constitution that will require future legislatures and governors to budget on the basis of generally accepted accounting principles.

I have again introduced legislation creating a constitutional amendment that would require the state to budget the same way that businesses, school districts, counties, townships, cities, and villages budget. The state should live by the same rules as our constituents. As a constitutional amendment, Senate Joint Resolution 55 and Assembly Joint Resolution 66 would need passage by two consecutive sessions of the State Legislature and require the approval of voters statewide before becoming law.