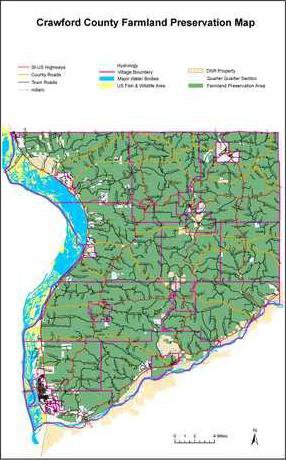

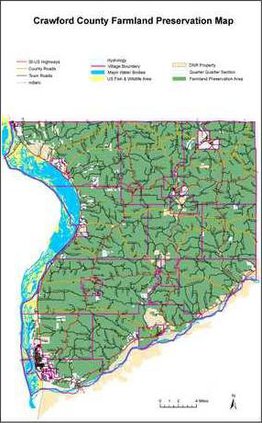

The Crawford County Farmland Preservation Plan (FPP) and map are currently moving toward an update.

The Crawford County Board, Soil and Water Concerns Committee, held a public hearing on Tuesday, April 18 in Prairie du Chien.

Following a public comment period which closes on Friday, April 27, the final draft plan and map will be reviewed by the Land Conservation Committee at their May meeting, and then presented for review to the Crawford County Board of Supervisors in June.

“The goals of the 1981 plan and the current draft are essentially the same, centered on the big idea of preserving farmland in the county,” according to Crawford County Conservationist David Troester. “The 1981 plan looked a bit more at the details of each township. Now we look at agriculture in the county as a whole. Some areas of the county have changed quite a bit, while most of the county is still very rural. There are more corn and soybean acres, while livestock numbers are down, and on many fewer farms.”

A copy of the draft plan and map can be found at the county’s website, Land Conservation Committee, News and Updates page.

Comments can be e-mailed to Troester, at dtroester@crawfordcountywi.org.

Zoning and tax credits

As contracts made under the original 1981 FPP expire, for farmers to meet the program requirements and claim the tax credit, they will need to be in a township or village with FPP Zoning.

Landowners can also petition the state to create an Agricultural Enterprise Area (AEA), which is an avenue to receive a tax credit for those not covered by the zoning. For those covered by the zoning, establishing one is an avenue to receive additional tax credit dollars. To date, no AEA’s have been created in the county.

Townships and villages in the county can apply to the Wisconsin Department of Agriculture, Trade and Consumer Protection (DATCP) for zoning certification if they meet or exceed state farmland preservation standards. Text and maps as well as spatial location data used to create the maps must accompany the application.

The dollar amount of the per acre tax credit for landowners enrolled is $7.50 per acre. Landowners enrolled under an AEA receive a $5 per acre credit, and a $10 per acre credit if they are also in an area with FPP zoning.

Landowners who have contracts under the old FPP are receiving $3-5 per acre, a shortfall of $2.50 to $4.50 per acre compared to the amount they could receive if zoning were in place.

The purpose of the county creating the map is to identify the areas in the county that are excluded from participation, mainly because they are commercial or residential. To be eligible to participate in the program, the area for a proposed zoning change must be included on the county’s map.

“The requirements put forth in the plan are pretty much already in place, through state laws and administrative code, even without enacting the zoning,” explained Troester.

“The zoning by itself doesn’t do anything for you or to you. The zoning just makes landowners eligible for the tax credit in exchange for agreeing to abide by certain state conservation standards.”

Some without zoning

Most of Crawford County’s townships to date have not elected to put in place zoning that would allow landowners access to the tax credit.

Currently Utica and Haney Townships, and the Village of Soldiers Grove, have successfully worked with the DATCP to enact the zoning.

As of April 2017, there are approximately 72 landowners claiming the tax credit through FPP zoning. Roughly 65 percent are in Utica Township, and 35 percent in Haney Township.

With a total of 15,900 acres enrolled, this represents $119,250 in tax credits that area landowners are currently realizing.

Town of Utica Board Chairman Leonard Olson, explained why Utica Township chose to enact the FPP zoning.

“Essentially, it’s the easiest way to connect township landowners with the FPP tax credits,” Olson said.

Currently, 17 ten-year contracts, grandfathered in through the original county FPP enacted in 1981, are scattered throughout the county in townships without the zoning in place.

Clayton Township Board Chairman Dennis Swiggum was not on the board when the decision was made not to pursue the zoning.

“Farmland Preservation Zoning is not something the Clayton Town Board is currently considering,” Swiggum said.

Harriet Behar, Secretary of the County LCC, and Chair of the Town of Clayton Plan Commission echoed this. “Our township residents were not interested in FPP like Haney and Utica, and so it is not in our Smart Growth plan.”

In Eastman Township. there are some new faces on the board since the April election.

“It’s definitely something the board needs to take a look at,” said Sam Tesar, the Eastman Township Board Chairman. “We will have our first meeting with the new board soon, and we’ll go from there.”

Tesar is familiar with zoning from the years he lived with his family in Southeast Wisconsin, and can see the benefit of it. The township does not currently have comprehensive zoning, so that would also need to be enacted to put the FPP zoning in place.

“The key thing is to get the community involved in developing the plan from the start,” Tesar noted. “Some people are afraid the zoning will prohibit them from sales of smaller parcels to family members, but other townships like Utica have solved that problem.”

David Olson, who wears many hats such as Freeman Township Board Chairman, County Board Supervisor, and Land Conservation Committee member, is aware that the FPP will soon come before the county board.

“Freeman Township has zoning, but not exclusive ag zoning currently,” explained Olson. “We do have residents with FPP contracts, though, and we’ll probably take a look at it.”

Another County Board Supervisor and Chairman of the Town of Scott Board, Wayne Jerrett, commented on the idea of enacting the zoning.

“Right now our people don’t want zoning – they made that clear in the last election,” Jerrett said.

Marietta Township only recently put in place the “village powers” that would allow the township to enact zoning. Like Eastman Township, they would also need to develop comprehensive zoning.

“It’s something we’ll probably be taking a look at,” Dean Roth, Marietta Township Board Chairman said. “There are people in our township who have contracts under the old plan.”

“We’ve discussed enacting the zoning before, and will continue our discussion at upcoming meetings,” Seneca Town Board Chair, Tim Ray said. “The board is very supportive of putting this zoning in place.”

Thomas Jazdzewski, Wauzeka Township Board Chairman, said the township does not currently have zoning, and has no plans to pursue it.

“We talked with David Troester about this, and helped him fill in the map for the township,” Jazdzewski explained, “but the farms in our township are probably too small for it to be of benefit to us.”

Existing FPP contracts made under the 1981 plan will not be eligible for renewal unless the township adopts the zoning.

Shifts in participation

Over the years, more than 150 different FPP agreements have been administered in the county, covering 25,481 acres.

In 2009, the year the Working Lands Initiative (WLI) replaced the 1981 version of the FPP, there were 75 FPP agreements, scattered around the county, totaling 15,650 acres. Because enactment of the WLI, which prevents expiring agreements to simply be re-enrolled, the number of active agreements at the end of 2015 was down to 26, totaling 5,827 acres. This represented a 77 percent reduction from the program’s heyday.

Since 2015, they’ve lost a few and gained a few, but generally the program is growing in the townships where the zoning is in place.

Pros and cons

The stated goals of the Farmland Preservation Plan include: balancing individual property rights with community interests; minimizing incompatible land uses; preserving land for agricultural use; supporting development that preserves working agricultural lands, protects the environment, and preserves quality of life and the rural landscape of the county; and creating an economic environment that encourages sustainable use of natural resources.

The tax credits from participation in the FPP mean money flowing into landowner’s pockets.

Requirements for participation in the FPP are identified in Chapter 91 of the Wis. State Statutes, and FPP elements are mandatory for counties intending to make benefits available to eligible landowners.

The county follows ATCP 50 Farm Conservation Standards, which regulate soil erosion, the phosphorous index, nutrient management, tillage setbacks, process wastewater, and also define when pastures require nutrient management planning.

Most of the downside of the program comes in the beginning, with the creation of a nutrient management plan. This is where the greatest one-time costs are incurred, if you contract with an agronomist.

The Crawford County Land Conservation Department has a list of agronomists who provide this service in the area.

It is possible to become certified to write your own nutrient management plan by attending a class at SWTC. Landowners can use the computer software, SNAP-Plus, which is designed to maximize farm income.

“I took the class at SWTC, and got reimbursed for the expense of it,” local farmer Jake Wedeberg reported. “I was able to use the SNAP-Plus software to write the plan not only for my family’s acres, but also for ground we rent. It saves the landowner of the rented ground a lot of bother, and it’s good for both of us.”

The landowner and farmer, in a rental situation, are responsible for updating the plan each winter for the upcoming growing season.

Each year, the county receives cost-share funding to help five or six landowners pay for the class at SWTC, and defray the initial cost of creating a nutrient management plan.

Soil samples are required every four years, and the cost roughly works out to about $2.50 per acre, or $0.60 per acre per year.